The Complete Personal Finance Master Class Bundle

What's Included

The Complete Personal Finance Course: Save, Protect, Make More

- Experience level required: All levels

- Access 107 lectures & 12 hours of content 24/7

- Length of time users can access this course: Lifetime

Course Curriculum

107 Lessons (12h)

Your First Program

Course Introduction & How to Take this Course

Course Introduction (Are You Ready to Save, Make & Protect Your Money?)5:58How to Take this Course (and Using Your “Complete Personal Finance Dashboard”)11:50Part 1 of 3: Save [MORE] Money & Making Your Money Work For You!

Introduction to Saving [MORE] Money & The INCREDIBLE Power of Compound Interest20:14Exercise #1: Time Value of Money (Small Changes Lead to Fortunes Later in Life!)1:08Answers to Exercise #1, Question s 1 through 7: Time Value of Money16:47Answers to Exercise #1, Question s 8 through 10: Time Value of Money6:28[Optional] Side Note: Get Free Daily Helpful Business & Career Development VideosSave by Calculating Where Your Cash is Going: Your CURRENT Income Statement

What is a Personal Income Statement and Why is this Very Important?2:04Exercise #2: Money In & Money Out: Creating Your CURRENT Income Statement5:56Discussion of Your Answers to Exercise #21:12More than 100 Ways to Save MUCH More:Creating Your NEW+IMPROVED Income Statement

Introduction to Completing Your NEW & IMPROVED Income Statement6:16Save on Taxes: 14 Ways to Save More on Taxes16:50Save on Car & Transportation: 13 Ways to Save More on Car or Transportation Expenses14:17Save on Child or Child Care: 5 Ways to Save More on Child or Child Care Expenses8:36Save on Communications Computer: 6 Ways to Save More on Phone Computer Expenses5:45Save on Debt Payments: 7 Ways to Save More on Debt Expenses5:58Save on Education: 4 Ways to Save More on Education Expenses2:21Save on Entertainment: 7 Ways to Save More on Entertainment Expenses5:23Save on Fees [Many are Hidden]: 6 Ways to Save More on Fees Expenses6:57Save on Food & Drinks: 13 Ways to Save More on Food & Drinks Expenses9:31Save on Gifts & Donations: 4 Ways to Save More on Gifts & Donation Expenses4:07Save on Health Fitness Life Insurance: 4 Ways to Save More on Health Expenses3:09Save on Housing: 10 Ways to Save More on Housing Expenses11:10Save on Personal Care: 5 Ways to Save More on Personal Care Expenses5:45Save on Pets: 5 Ways to Save More on Pet Related Expenses1:42Save on Shopping: 16 Ways to Save More on Shopping Expenses12:26Save on Vacation: 5 Ways to Save More on Vacation Expenses3:05Save on Other Expenses: 8 Ways to Save More on Other Expenses7:51Exercise #3: Creating Your NEW & IMPROVED Income Statement2:03Exercise #4: Analyzing Your CURRENT and New+IMPROVED Income Statement5:46Exercise #5: Save Money Meeting1:42Exercise #6: Save Money Checklist2:52Changing Your Perception of Saving Money + Saving Money and Your Kids

Changing Your Perception of Money13:48Saving Money & Your Kids8:29Part 2 of 3: Protect [MORE] Money (Many Ways to Protect Your Money)

Intro. to Protecting Your Money: The What, Why & How of Part 2 of the Course3:38Protect Your Money by Understanding Your Net Worth (Your “Balance Sheet”)4:10Exercise #7: Creating & Understanding Your Balance Sheet (“What You Own and What You Owe”)5:41Exercise #8: Analyzing Your Balance Sheet4:15Exercise #9: Analyzing Your Balance Sheet AND Your Income Statement Together4:52Side Note: Should You Hire a Financial Advisor to Help Protect Your Money?5:23Protect Your Money with These Tax Strategies

Keep All Receipts + Consider Hiring an Accountant (They’re GREAT Investments!)10:35How Taxes+Retirement Accounts Work & Why We Need to Minimize How Much Tax We Pay17:56Exercise #10: How Much Do You Need to Retire?6:09Tax Incentives Help You Save BIG TIME for Education_School Expenses3:42Exercise #11: How Much Do You Need for Education Expenses?1:04Other Potential Company Sponsored Tax Savings Plans1:34Exercise #12: Pay Less Tax Strategies1:15Protect $ by Having an Organized Filing System, Tracking Bills & More

Exercise #13: A Simple & Effective Money, Taxes, Receipts and Statements Filing System18:01Websites & Apps to Help You Track and Manage Your Spending6:12Quicken on a PC to Manage Your Money8:37Quicken on a Mac to Manage Your Money6:49Protect Your Money by Creating a Budget & Picking the Right Bank

Introduction to Protecting Your Money by Making a Monthly Budget2:22Exercise #14: Budget Planning4:31Is Your $ Safe? Are Your Getting Ripped off on Fees? Should You Switch Banks8:25Exercise #15; Is Your Money Safe? Protect Your Money by Using the Right Bank6:15Protect Your Family with Wills & Trusts and Accessing & Fixing Your Credit Score

Wills and Trusts5:15Viewing, Understanding and Fixing Your Credit Score_Rating (So You Can Get a Loan or Mortgage)10:32Protect Your Family and Your Assets with Insurance Products

Introduction to Insurance10:04Life Insurance6:09Auto Insurance2:26Home and Property Insurance4:45Health Insurance1:31Side Note: Protect Your Money by Preventing Identity Theft9:19Protecting Your Money, Credit Cards, Loans and Leases

Credit Cards6:52Loans5:11Leases5:26Profiles of Successful Wealthy People & How they Protect and Manage Their Money

They Stay Wealthy for a Reason + 5 Characteristics of Billionaires I Have Worked For10:27Exercise #16: Protect Money Checklist0:37Part 3 of 3: Make [MORE] Money (Ways to Make Your Money Work for You)

Introduction to Making [MORE] Money: The What, Why & How of Part 3 of the Course10:11Exercise #17: The Damage that High Investment Fees Can do to Our Net Worth!4:21Make More by Learning How to Avoid Paying High Investment Fees10:23Index Funds Examples

An Example of a GREAT Index Fund Firm to Buy Financial Products from: “Vanguard”4:30Examples of Other ETFs to Buy Index Products From9:10Side Note: Outta Sight and Outta Mind1:52Introduction to your Investment Portfolio Management System

Managing Your Investments with Your Investment Portfolio Management System8:40Exercise 18: Populating Your Investment Portfolio Management System (meaning Your Portfolio)11:24Make Money with Stocks

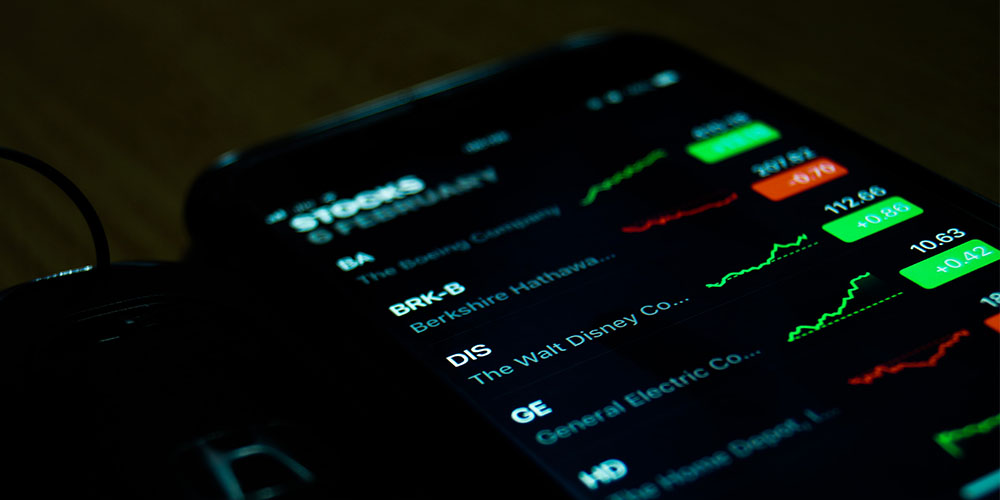

Introduction to Investing in Stocks and 4 CRUCIAL Stock Investing Rules14:38Investment Data Basics (See SECTION A on Your Investment Portfolio Management System)9:41Your Ownership Amounts in Stocks and ETFs (See SECTION B on Your Invstmt Portfolio Mgmt Syst.)2:58Risk Management (See SECTION C on Your Invstmt Portfolio Mgmt Syst.)7:38Sector and Stock Drivers (See SECTION D on Your Invstmt Portfolio Mgmt Syst.)4:12Your Research (See SECTION E on Your Invstmt Portfolio Mgmt Syst.)12:44Add More Optional Data (See SECTION F on Your Invstmt Portfolio Mgmt Syst.)0:26Stock Valuations, Mutual Funds & Warren Buffett’s Favorite Type of Investments

Exercise #19: Stock Valuations16:58Mutual Funds3:48Side Note: What Are Warren Buffett’s Favorite Types of Investments?1:45Make Money with Bonds & Commodities (& Understanding Interest Rates)

Introduction to Interest Rates, Bonds and “The Bigger Picture”4:31Global Economics and Why this Matters to Personal Investors13:17Understanding Foreign Exchange Currency Movements8:08Bonds and How Can Governments Stimulate the Economy?10:25PART1 How do Bonds Work (With Real Corporate and International Government Examples) 19:40PART2 How do Bonds Work (With Real Corporate and International Government Examples)18:35Exercise #20: Adding Bond Investments to Your Portfolio5:54Investing in Commodities8:14Exercise #21: Adding Commodity Investments to Your Portfolio6:24Make Money with Real Estate

Introduction to Your Most Important Personal Investment & How Much Should You Spend on a House?13:38How Mortgages Work & How to Calculate Payments (Fixed Rates Versus Interest Only Rates & More)8:09Exercise 22: Mortgage Calculator3:55Investment Property: What You Need to Know if Considering Investment Properties12:03Investment Property: How Much Should You Spend on an Investment Property?3:09Exercise #23: Adding Real Estate Investment Trust Investments to Your Portfolio7:00Side Note: 4 Investment Categories to Consider Avoiding Given Liquidity Risks9:00Make More with Diversification & Your Make Money Checklist

Diversification Strategies and Your Diversified “Model Portfolio”13:41PART 1 Exercise #24: Diversification & Your Model Portfolio20:18PART 2 Exercise #24: Diversification & Your Model Portfolio3:32Exercise #25: Make Money Checklist0:42Introducing Our NEW MBA Degree Program2:44

The Complete Personal Finance Course: Save, Protect, Make More

Chris Haroun is an award-winning business school professor, venture capitalist, MBA graduate from Columbia University and former Goldman Sachs employee. He has raised/managed over $1bn in his career. He also has work experience at hedge fund giant Citadel, consulting firm Accenture, and several firms that he has started, including an investment firm that had a venture capital / private investment in Facebook several years before the Facebook IPO. He is the founder and CEO of Haroun Education Ventures.

According to Business Insider "Haroun is one of the highest-rated professors on Udemy, so you can expect to be in good hands through the course of your education."

848,585 Total Students

117,588 Reviews

Description

Hate it or love it, everybody has to have a firm grasp of personal finance. Struggling to wrap your head around how to manage your personal finances? Here's the course for you. This course operates on three pillars: Saving Money, Protecting Money, Making Money. With lessons on how to better manage and grow your finances, as well as a comprehensive Excel spreadsheet that contains more than 25 exercises to help you save, protect and make more money, this is the all-inclusive stop to putting your money on the right track.

- Access 107 lectures & 12 hours of content 24/7

- Learn how to analyze & significantly decrease your personal expenses

- Discover more than 100 ways to help you save more money

- Discuss tax filing, budgeting, investing in stocks & bonds, and more

- Understand & improve your credit score

- Explore wills, trusts, estate planning, mortgages, & more

- Protect your family & possessions using insurance products

All featured courses are designed for educational purposes only and do not reflect our views or recommendations. Please note that all course purchasers invest at their own risk.

Specs

Important Details

- Length of time users can access this course: lifetime

- Access options: desktop & mobile

- Certification of completion included

- Redemption deadline: redeem your code within 30 days of purchase

- Updates included

- Experience level required: all levels

- Have questions on how digital purchases work? Learn more here

Requirements

- Any device with basic specifications

Volume Trading 101: Day Trading Stocks With Volume Analysis

Day Trading 101: A Beginner's Guide to Trading Stocks

Introduction to Commercial Real Estate Analysis

Fundamentals of Real Estate Investment Analysis

Personal Finance Masterclass

The Complete Personal Finance Course

CFA Level 1 Quantitative Analysis

The Complete Financial Analyst Training & Investing Course

Terms

- Unredeemed licenses can be returned for store credit within 30 days of purchase. Once your license is redeemed, all sales are final.

TyKisha Presley

This is an outstanding deal. There are several classes and each one is incredibly in-depth. "MasterClass" is right!

Zaim Zawawi

I am able to learn about basics and advanced personal finance, to keep track of my expenditures, and to start trading for extra income.